-

072022-12

-

032022-12

-

212022-11

-

142022-11

-

282022-10

新闻中心

— News —

关注实时动态,记录点滴进步。

企业业绩

— Products —

相信品牌,选择品质,选择我们.

关于我们

— About us —

因为有态度,选择我们。

About us

极速电竞官网(中国)有限公司官网

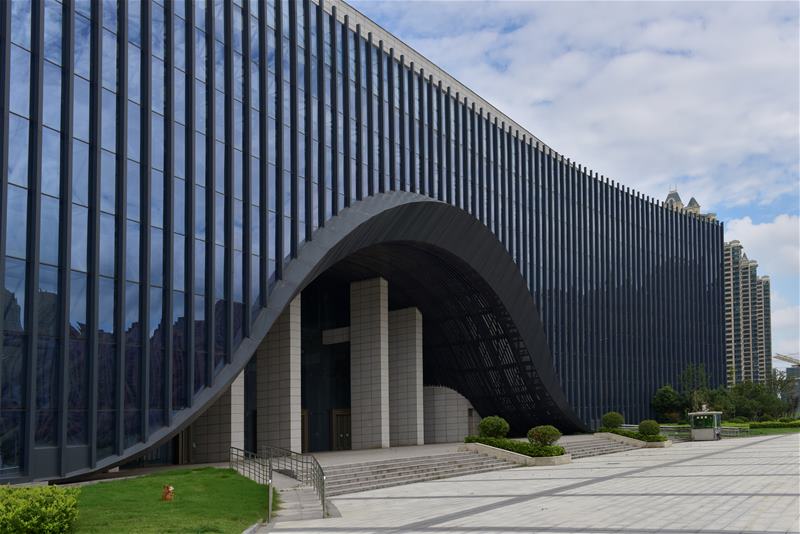

极速电竞官网(中国)有限公司官网成立于1997年3月,是以建筑装饰、幕墙设计与施工为主体,涵盖机电安装工程、智能化工程、消防工程、钢结构工程、展览工程设计与施工等为一体的市场经营实体。坚持走绿色、低碳、文化、科技创新之路,引导行业发展潮流,成为中国建筑装饰行业先锋。

查看更多>>